5 MORTGAGE QUESTIONS HOME BUYERS ALWAYS ASK-ANSWERED

Is a 20% down payment always necessary? The common recommendation is to put down 20%, but there are alternatives for those without the full amount. One option is a Federal Housing Administration (FHA) loan, allowing borrowers to make a down payment as low as 3.5%, provided they meet specific criteri

Read MoreNot All Lenders Are the Same: Understanding Your Home Financing Options

When it comes to buying a home, choosing the right lender is as important as finding your dream property. The mortgage market is vast, but the majority of home loans are handled by three main types of lenders: banks and credit unions, mortgage brokers, and mortgage bankers. Each has its own approach

Read MoreWhat To Look For From This Week’s Fed Meeting

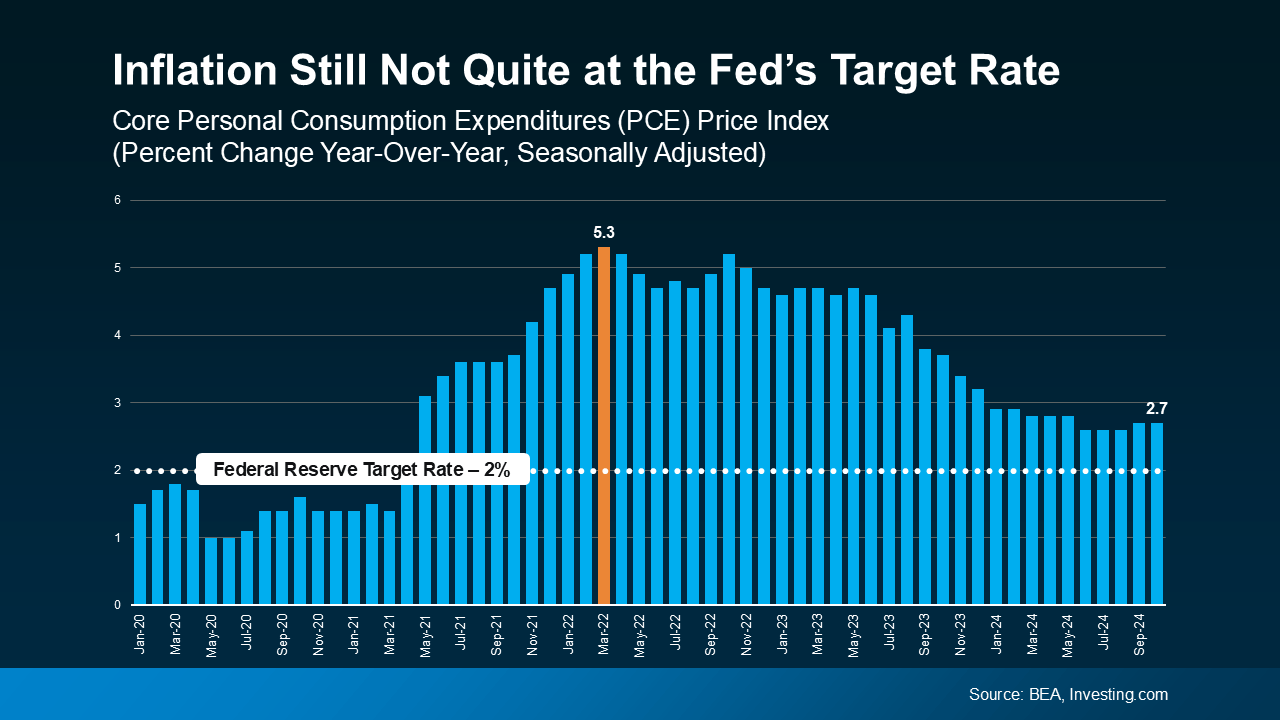

You may be hearing a lot of talk about the Federal Reserve (the Fed) and how their actions will impact the housing market right now. Here’s why. The Fed meets again this week to decide the next step with the Federal Funds Rate. That's how much it costs banks to borrow from each other. Now, that’s no

Read MoreWondering what the housing market might look like in 2025?

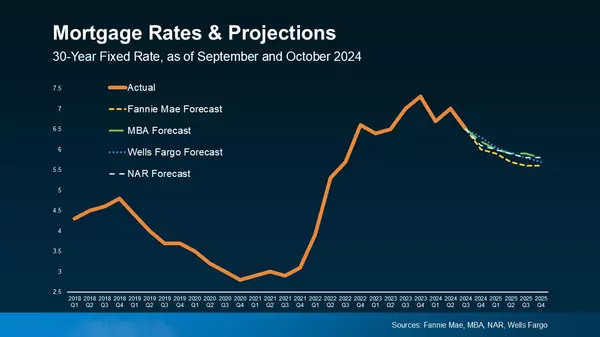

Wondering what the housing market might look like in 2025? Well, there’s good news ahead! Experts are predicting positive changes, particularly when it comes to two key factors: mortgage rates and home prices. Whether you're buying or selling, here’s a breakdown of what to expect and how it could a

Read More

Categories

- All Blogs 344

- 55+ Communities 9

- Boating Communities 9

- First Time Home Buyer 112

- Florida Lifestyle 67

- Foreclosures 2

- Fun Things to do in Lee County, Florida 37

- Golf Communities 23

- Home Buyer Tips 127

- Home Seller Tips 103

- Homeowner Tips 61

- Mortgage Tips 38

- Neighborhoods 65

- Schools 3

- Title & Escrow 3

- Title Insurance 4

Recent Posts