7 Critical Reasons Why Home Sales Fall Apart (And How to Keep Your Deal on Track)

Understanding the Frustration: The High Cost of a Broken Home Sale

Few things are more disheartening than the moment a real estate contract dissolves. Whether you're a buyer who's mentally moved into their dream home or a seller counting on the closing proceeds, a failed sale can cost time, money, and significant emotional stress.

For anyone navigating the competitive Fort Myers or Southwest Florida housing market, understanding the most common pitfalls is the key to a successful closing. Here are the 7 critical reasons why home sales fall apart and actionable advice on avoiding them.

1. The Home Inspection Nightmare

The inspection contingency is designed to protect the buyer, but it's the number one cause of broken deals. A standard pre-listing home inspection can uncover serious issues like foundation problems, a faulty roof, or major HVAC repairs.

-

Seller's Tip: Get a pre-listing home inspection before you put your house on the market. This allows you to address major issues upfront or disclose them, preventing a last-minute buyer surprise that leads to them walking away.

-

Buyer's Tip: Focus on "material defects" (safety and structure) rather than minor repairs. Be reasonable with your requests for repairs or credits.

2. Failure to Secure Financing (The Mortgage Trap)

Many home sales fall apart because the buyer's loan application is denied, even if they were pre-approved. Mortgage lenders look for any change in the buyer's financial status right up until closing.

-

Common Causes: The buyer bought a new car, opened a new credit card, quit a job, or simply had a lower-than-expected appraisal that impacts the Loan-to-Value (LTV) ratio.

-

Action Plan: Buyers must freeze all major financial changes between contract and closing. A strong pre-approval from a reliable, local lender is essential for a faster closing.

3. Appraisal Issues: The Value Gap

When the lender's appraisal comes in lower than the agreed-upon sale price, it creates a "value gap" and a major problem. Lenders will not fund a loan for more than the appraised value.

-

Solutions: The buyer can cover the difference in cash, the seller can lower the price to meet the appraisal, or both parties can negotiate a middle ground. Without an agreement, the real estate transaction is likely to fail.

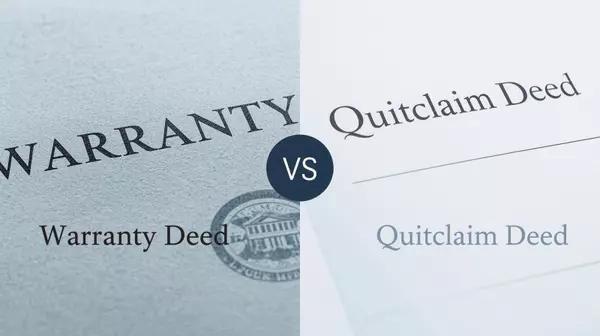

4. Title Troubles and Boundary Disputes

A clear title is mandatory. If the title search uncovers a lien, an undisclosed heir, or an encroachment (a structure on the property that crosses the boundary line), the home sale can be immediately jeopardized.

-

Protection: Always get title insurance. A reputable title company will flag these issues early on and work to resolve them before the closing date.

5. Buyer’s Remorse and Cold Feet

Sometimes, after the initial excitement, a buyer simply gets cold feet, often over the size of the mortgage or an unexpected family change. While frustrating, if they back out during the inspection contingency period, they do not lose their earnest money deposit.

6. Contract Disputes Over Contingencies

The written contract outlines crucial dates for inspections, financing commitments, and closing. Missing a deadline, failing to agree on repair credits, or trying to renegotiate terms after the fact can lead to mistrust and cause the entire real estate deal to unravel.

-

Pro Tip: Your experienced real estate agent is your best defense here, ensuring all deadlines are met and negotiations are handled professionally.

7. HOA Approval Denial

In communities with a Homeowners Association (HOA), the buyer must be approved by the board. If a buyer fails the HOA's background or credit check, the sale is over.

-

The Fix: Sellers should inform their agent about all HOA requirements, and buyers must submit their application immediately after going under contract.

Keep Your Sale Together: Your Next Step

The best defense against a failed home sale is working with a top-rated real estate professional who has a track record of guiding clients through these complex issues. Don't let your dream home slip away.

Categories

- All Blogs 347

- 55+ Communities 9

- Boating Communities 9

- First Time Home Buyer 113

- Florida Lifestyle 67

- Foreclosures 2

- Fun Things to do in Lee County, Florida 37

- Golf Communities 23

- Home Buyer Tips 128

- Home Seller Tips 104

- Homeowner Tips 61

- Mortgage Tips 38

- Neighborhoods 66

- Schools 3

- Title & Escrow 3

- Title Insurance 4

Recent Posts

GET MORE INFORMATION

Billee Silva, PA, ABR SRS

Licensed Realtor | License ID: P3275278

Licensed Realtor License ID: P3275278