Why Mortgage Rates Ticked Higher Even Though the Fed Just Cut Rates

What’s Going On: The Big Picture

-

The Fed’s cut (to around 4.00%-4.25% for the federal funds rate) is meant for short-term lending among banks. Mortgage rates, especially for 30-year fixed loans, are much more influenced by what investors expect inflation, the economy, and bond yields to do over the next several years.

-

Long-term bond yields, especially the 10-year U.S. Treasury, have ticked up. When those yields rise, lenders need to offer more return (to compete), and that pushes mortgage rates up.

-

Market expectations: many investors had already priced in the Fed’s rate cut before it was officially announced. So when the cut came, there wasn’t much “new” to push mortgage rates lower; instead, the market focused on Fed’s commentary, inflation data, and what future rate cuts might look like. If the Fed signals they may be cautious or slow to move, that tends to put upward pressure on mortgage rates again.

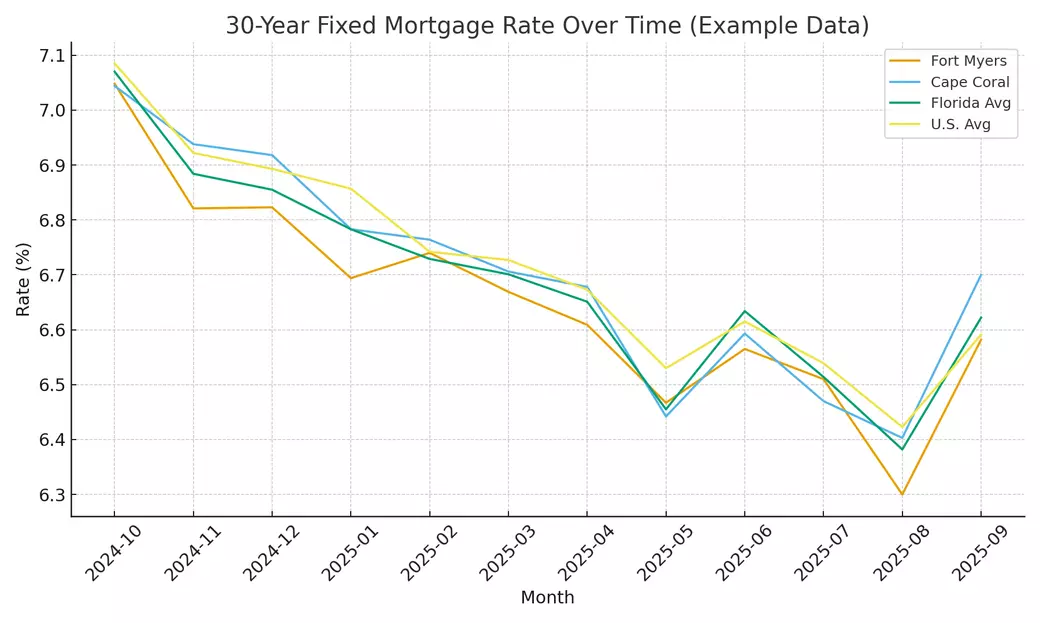

Fort Myers-Cape Coral Snapshot: What the Rates Look Like Locally

-

In Fort Myers, Cape Coral, and the local area, the current average mortgage rates are in line with what’s happening statewide. For instance, a 30-year fixed-rate mortgage in Florida is currently around 6.22% to 6.30%.

-

For a 15-year fixed mortgage, many borrowers are seeing rates in the 5.25%–5.50% range, depending on credit, down payment, and lender.

-

Rates may vary depending on neighborhood, loan type (e.g. FHA, VA, conventional), credit score, and how big your down payment is. Fort Myers/Cape Coral lenders are still adjusting based on these risk factors.

Why They Went Up Despite the Fed Cut

-

Because long-term bond yields rose after the Fed’s announcement. Even though the Fed cut its rate, inflation concerns (especially from recent reports) and economic data that looked strong in some sectors made bond investors demand higher yields. That pushed mortgage rates up in response.

-

The Fed’s wording matters: if they suggest that future cuts are limited or that inflation remains a concern, markets may respond by increasing mortgage rates. They need to price in risk.

-

Local lenders in Fort Myers and Cape Coral are also watching what inflation and housing inventory are doing.

What This Means If You’re Looking to Buy or Refinance in Fort Myers and Cape Coral

-

Locking in might make sense if you’ve found a rate you’re comfortable with. Waiting for rates to drop may sound tempting, but right now it’s a buyer’s market with plenty of inventory to choose from. If and when rates do come down, competition will heat up, and the savings from a slightly lower rate could be outweighed by rising prices and multiple-offer situations.

-

If your credit is strong (good credit score, stable income, lower debt), and you can make a sizable down payment, you’ll be in a better position to get favorable rates.

-

Look beyond the headline rate. Ask about APR, points, fees, closing costs. What looks like a low rate may not be if the upfront costs are high.

-

Keep an eye on inflation reports (CPI), job market data, and what the Fed says in upcoming Communications. Those are often early warning signs for where rates are likely headed.

-

Also consider adjustable-rate mortgages (ARMs) if you plan to stay in a home for a shorter time. They may offer lower initial rates. But be mindful of what happens when they adjust.

Bottom line: Even though the Fed cut rates this week, mortgage rates didn’t drop sharply in Fort Myers and Cape Coral. They’re being held up by inflation expectations, bond market behavior, and cautious remarks out of the Fed. But there are signs moving the right way, and being prepared (credit, down payment, timing) can make a difference.

The good news: Even with this week’s move, mortgage rates are still lower than they were just a few weeks ago.

Categories

- All Blogs 344

- 55+ Communities 9

- Boating Communities 9

- First Time Home Buyer 112

- Florida Lifestyle 67

- Foreclosures 2

- Fun Things to do in Lee County, Florida 37

- Golf Communities 23

- Home Buyer Tips 127

- Home Seller Tips 103

- Homeowner Tips 61

- Mortgage Tips 38

- Neighborhoods 65

- Schools 3

- Title & Escrow 3

- Title Insurance 4

Recent Posts

GET MORE INFORMATION

Billee Silva, PA, ABR SRS

Licensed Realtor | License ID: P3275278

Licensed Realtor License ID: P3275278