Debunking Myths About Home Financing: The Truth Every Buyer Should Know

Buying a home can feel like an impossible dream, especially with so much misinformation swirling around. If you think owning a home is out of reach, it’s time to separate fact from fiction. Let’s bust some of the most common myths about home financing and empower you with the knowledge to take the first steps toward homeownership.

Myth #1: You Need to Be Wealthy to Own a Home

Fact: You don’t have to be a millionaire to buy a home. Many programs are designed to make homeownership accessible for people from all financial backgrounds. From FHA loans with low down payment requirements to USDA loans for rural areas, there are plenty of options to suit different income levels.

Myth #2: If You’re Paying Rent, You Can’t Afford a Mortgage

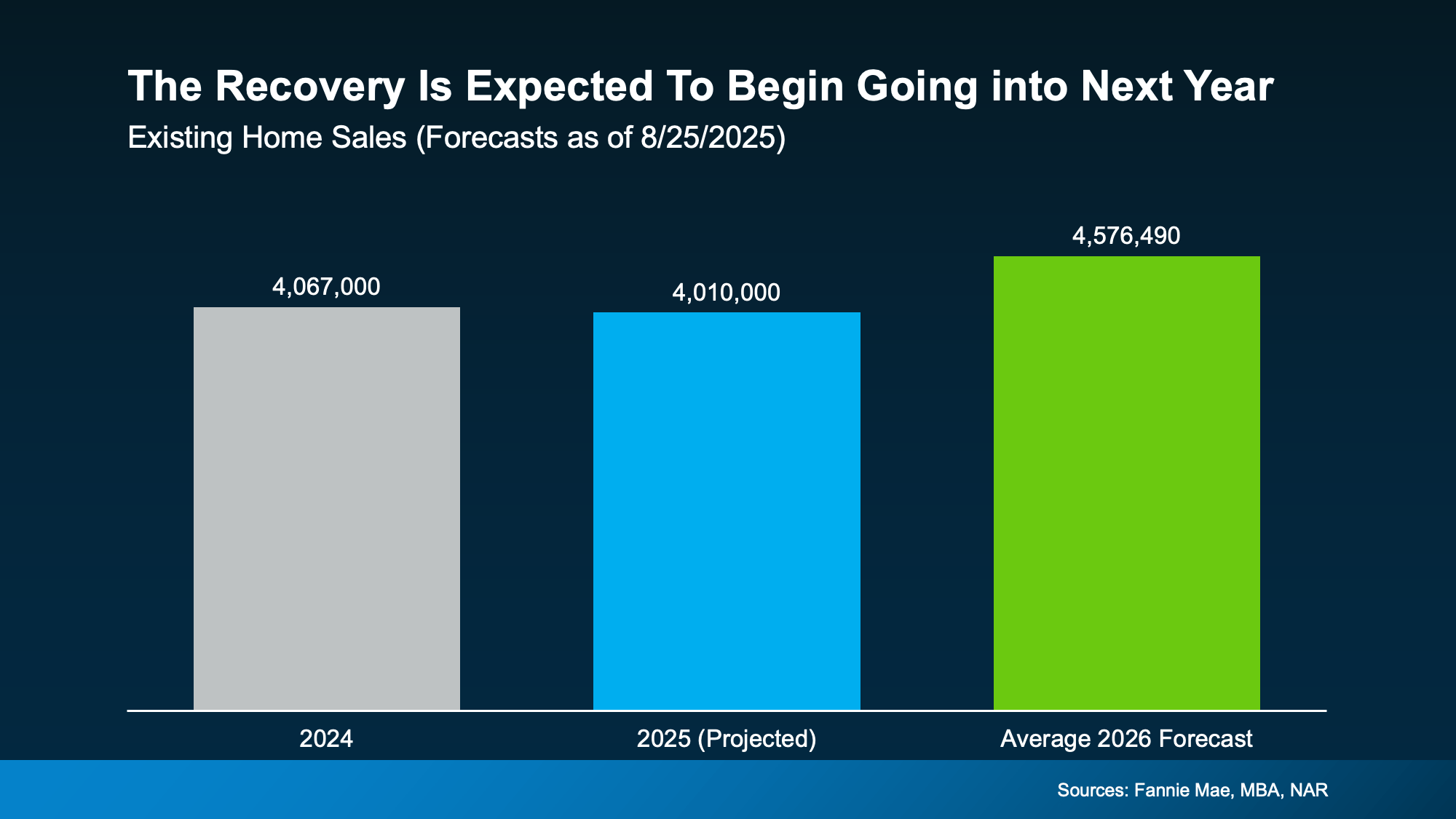

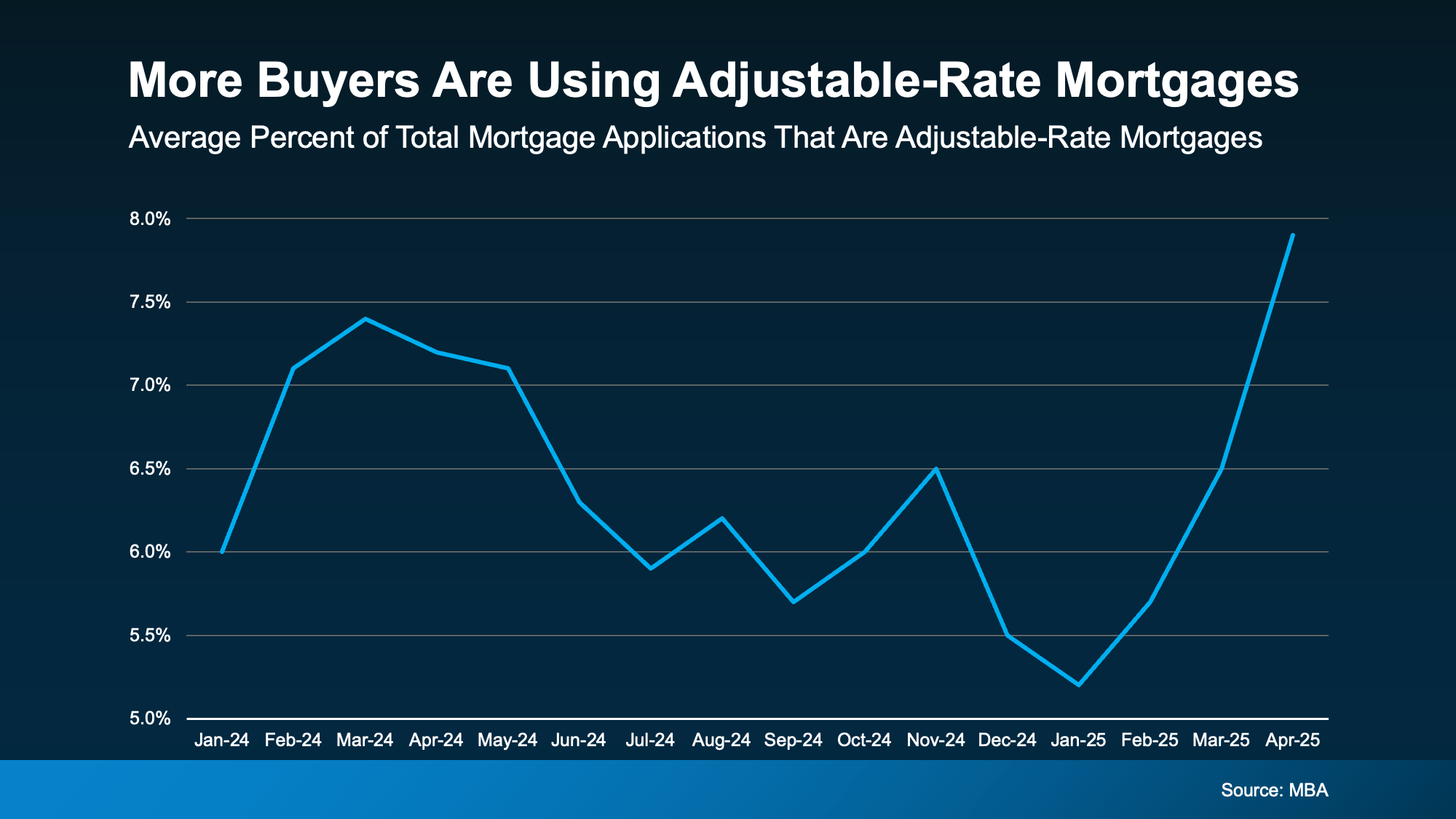

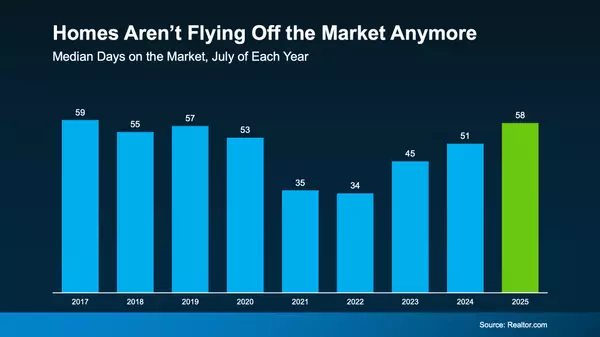

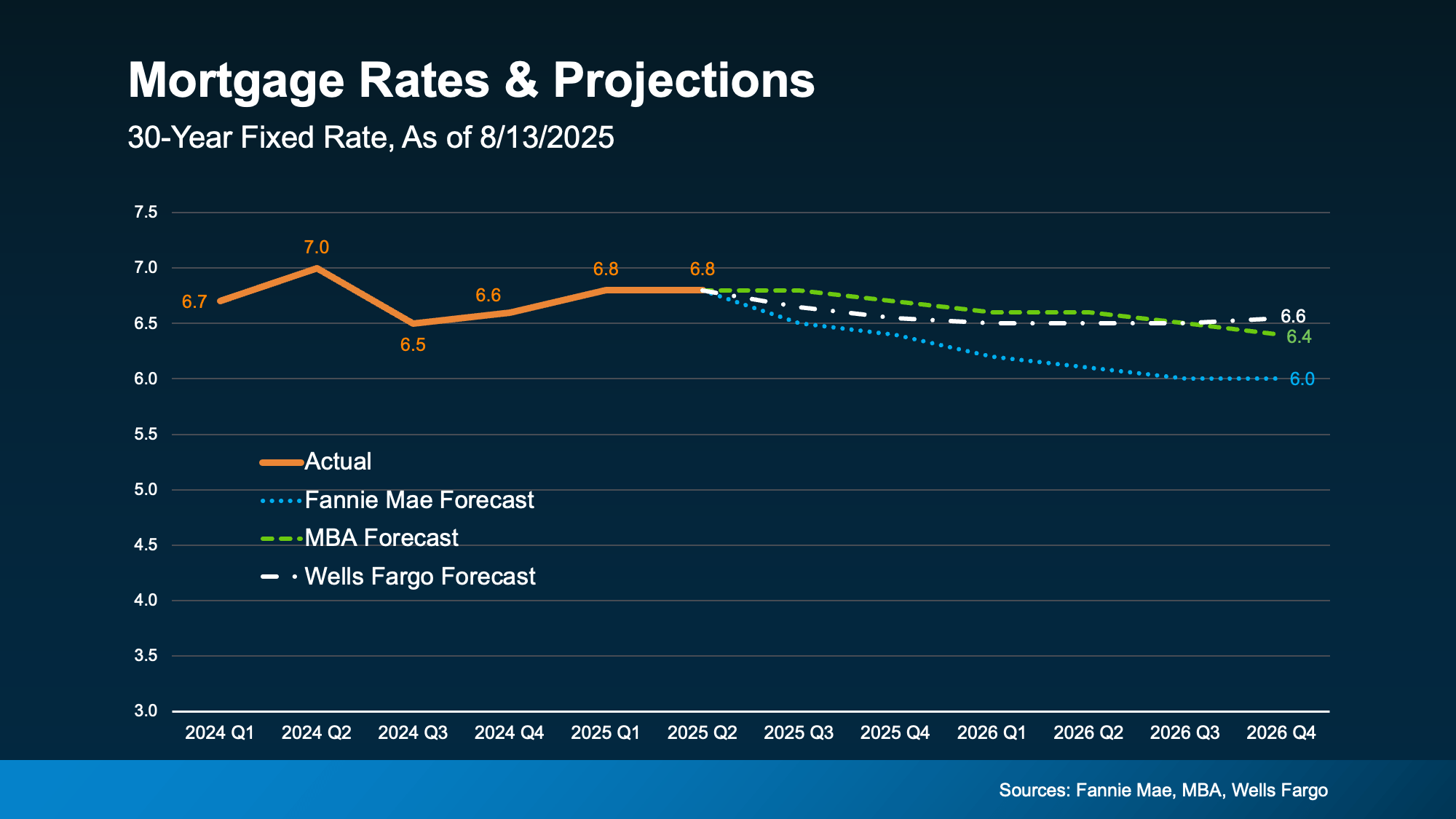

Fact: In many cases, paying rent is more expensive than owning a home. Rent doesn’t build equity, while mortgage payments contribute to your financial future. While interest rates have risen from historic lows, they remain competitive, and transitioning from renter to homeowner might be more attainable than you think.

Myth #3: You Must Be at the Same Job for Two Years or More

Fact: Lenders look at income stability, not just the length of time at your current job. If you’ve recently changed positions but have a consistent work history, you can still qualify for a mortgage.

Myth #4: You Need a Perfect Credit Score

Fact: While a higher credit score can unlock better rates, you don’t need perfection. Many loan programs accept credit scores as low as 580, and some options are even available for borrowers with scores in the 500s. Keep in mind that mortgage credit scores often differ from the free scores you see online, so don’t assume you’re unqualified without speaking to a lender.

Myth #5: You Need a Huge Down Payment

Fact: The days of requiring 20% down are long gone. Many programs allow as little as 3-5% down, and VA and USDA loans may even offer zero-down options. Plus, you can often use gifted funds from family or friends to help with your down payment.

Myth #6: Rates Are Higher for First-Time Buyers

Fact: First-time homebuyers often qualify for special programs and incentives, including lower interest rates. Being new to homeownership doesn’t penalize you, it might even work in your favor.

Myth #7: Owning a Home Is Always More Expensive Than Renting

Fact: While buying a home involves upfront costs, the tax benefits of homeownership, like deductions for mortgage interest and property taxes, can make owning cheaper in the long run. Additionally, each mortgage payment builds equity, unlike rent, which only benefits your landlord.

Myth #8: You Can’t Afford Closing Costs

Fact: Closing costs, pre-paid items, and escrow fees are part of the homebuying process, but they don’t have to break the bank. In many cases, you can negotiate to have the seller cover some or all of these costs or roll them into the purchase price. Pre-paid items include property taxes and homeowners insurance, while escrow ensures these payments are managed smoothly.

Additional Facts You Should Know

- You Can Build Closing Costs into the Sales Price: If you’re tight on funds, this strategy can help reduce upfront costs while still securing your home.

- Special Financing Programs Exist: From state-specific grants to down payment assistance programs, many resources are available to make homeownership more attainable.

- Pre-Approval Simplifies the Process: Before you shop for a home, get pre-approved to understand how much you can afford and demonstrate your seriousness to sellers.

The Bottom Line

Don’t let myths keep you from owning a home. The truth is, homeownership is more accessible than most people realize. With the right knowledge, a trusted real estate professional, and a lender who understands your unique situation, you can take control of your financial future and make your dream of owning a home a reality.

Categories

Recent Posts

GET MORE INFORMATION

Billee Silva, PA, ABR SRS

Licensed Realtor | License ID: P3275278

Licensed Realtor License ID: P3275278