What Happens Once You’re Under Contract? A Step-by-Step Guide for Florida Homebuyers

You’ve found the perfect home, your offer has been accepted, and now you’re officially under contract! 🎉 But what happens next?

For many buyers, this is where the process starts to feel a little overwhelming. Between deposits, inspections, loan approvals, and title work, there are a lot of moving parts, and understanding the timeline can help everything go smoothly. Here’s what you can expect once you’re under contract on a home in Florida.

1. Submitting Your Earnest Money Deposit

Within three business days of going under contract, buyers typically need to submit their earnest money deposit to the title company listed in the contract.

This deposit shows good faith and commitment to the purchase. The title company holds it in escrow until closing. The amount varies, but it’s usually around 1–3% of the purchase price, depending on what was agreed upon in the offer.

💡 Pro tip: Always make sure you wire funds directly to the title company, and verify wiring instructions by phone to avoid scams.

2. The Financing Process

If you’re getting a mortgage, your lender will begin processing your loan right away. Be prepared to provide updated financial documents like pay stubs, bank statements, and tax returns.

Shortly after applying, your lender will issue a Loan Estimate (LE) , thie will be done within three business days. This document outlines your estimated interest rate, monthly payment, closing costs, and cash needed to close.

Once your loan is fully underwritten and approved, you’ll receive a Closing Disclosure (CD) at least three business days before closing. The CD details your final numbers, so you’ll know exactly what to bring to closing and what your payment will be.

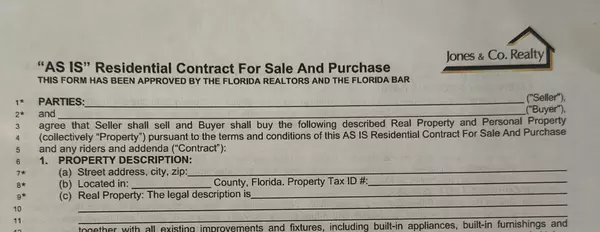

3. Inspection & Contingencies

In Florida, most contracts are written as “As Is” with the right to inspect. That means you can back out for any reason during the inspection period, typically 7 to 15 days, without penalty, as long as you do so in writing before the deadline in the purchase contract.

This is your time to schedule a home inspection, review the report, and decide if you’d like to move forward or negotiate repairs or credits.

4. Staying on Top of Deadlines

Your contract will have multiple deadlines, for inspections, financing approval, appraisal, HOA applications, and closing. Missing one could put your deposit at risk.

That’s why it’s so important to work closely with your Realtor, lender, and title company. A good Realtor will keep you on track and ensure nothing slips through the cracks.

5. The Title Search & Commitment

The title company plays a huge role behind the scenes. Once they receive the contract, they:

-

Perform a title search to verify the seller legally owns the property.

-

Identify any liens, judgments, or unpaid taxes that must be cleared before closing.

-

Issue a title commitment, which outlines what’s required to deliver clear title.

-

Coordinate the closing, prepare final documents, and record the deed after closing.

The title company ensures that when you take ownership, the home is legally yours, with no hidden surprises.

6. HOA or Condo Application (If Applicable)

If the home is located in a homeowners association (HOA) or condominium community, you’ll likely need to complete an application and pay an application fee and often they will do a background check on you.

You need to have HOA approval before closing, so submit your paperwork as soon as possible to avoid closing delays.

7. Financing & Appraisal Contingency

Most contracts include a finance contingency, which protects your deposit if you’re unable to secure a loan within a set timeframe. Your lender will also order an appraisal to confirm the home’s value supports your loan amount.

If the appraisal comes in low, your Realtor will guide you through options like renegotiating with the seller or adjusting your down payment.

8. The Final Walkthrough & Closing Day

On closing day, or the day before closing, you’ll do a final walkthrough to make sure the home is in the same condition as when you made your offer, and that any agreed-upon repairs have been completed.

On closing day, you’ll sign your loan and title documents, submit your final payment, and receive the keys to your new home. Congratulations, you’re officially a homeowner! 🏡

Final Thoughts

Going under contract is an exciting milestone, and with the right guidance, the process doesn’t have to be stressful. When you understand each step and stay ahead of deadlines, you’ll move through inspections, financing, and closing with confidence.

If you’re thinking about buying a home in Southwest Florida and want a Realtor who will walk you through every step of the process, from contract to closing, I’d love to help.

Categories

- All Blogs 347

- 55+ Communities 9

- Boating Communities 9

- First Time Home Buyer 113

- Florida Lifestyle 67

- Foreclosures 2

- Fun Things to do in Lee County, Florida 37

- Golf Communities 23

- Home Buyer Tips 128

- Home Seller Tips 104

- Homeowner Tips 61

- Mortgage Tips 38

- Neighborhoods 66

- Schools 3

- Title & Escrow 3

- Title Insurance 4

Recent Posts

GET MORE INFORMATION

Billee Silva, PA, ABR SRS

Licensed Realtor | License ID: P3275278

Licensed Realtor License ID: P3275278